CENTER-STATE RELATIONS

- Uttarakhand

- In Uttarakhand, 12-13 MLAs were opposing the CM's position. The speaker used a Voice vote to pass the budget on the day of the Budget passing.

- [* Voice vote- Speaker will ask how many are in favour of Ayes and Nos. Based on the voice, voting can be done]

- The opposition party demanded Voting but the house was adjourned sine die.

- Governor sent the report to the centre that constitutional machinery has failed.

- SC said that corruption can not be grounds to decide the breakdown of constitutional machinery. SC came to the rescue of the state legislative assembly.

- Arunachal Pradesh

- SC asked for the Governor's report which led to the imposition of the President's rule. SC immediately reinstated the CM and asked to prove his majority within 48 hours. SC stated that Governor's office is a constitutional office and it should not be actively involved in Politics.

- CM survived the Confidence motion and he resigned from the post.

- SC reinstated the previous CM, SC revoked the imposition of Article 356, etc.

MISUSE OF DISCRETIONARY POWERS OF THE GOVERNOR

- Discretionary powers

- a) Appointment of CM

- b) Passing of the Bills

- c) Recommending the imposition of Article 356

- Misuse of the discretionary powers

- M M Punchi Commission recommendations to appoint the CM in the case of Hung assembly

- The governor can invite the leader of the single largest party.

- The governor can invite the leader of the pre-poll alliance.

- The governor can invite the leader of the Post-poll alliance.

- Governor can also invite the Post-poll alliance with support from outside.

- Example- Karnataka and Goa case study

- Karnataka-

- 2018 elections were held and it was a Hung assembly and BJP emerged as the single largest party.

- Governor invited the BJP to form the government and gave them 15 days time to prove the majority.

- Congress party approached the SC.

- SC stated that it can not question the discretionary powers of the Governor but it reduced the 15 days time to 48 hours to prove the Majority.

- Goa-

- In Goa, the Congress party emerged as the single largest party. BJP joined hands with the independent MLAs and formed the post-poll alliance.

- Governor invited the BJP to form the government.

- SC again stated that it cannot question the Discretionary powers

- Maharashtra

- BJP and Shivsena fought as a coalition. After the election, Shivsena broke the coalition.

- Governor did not verify the name of the MLAs who supported

- Misuse in the Passing of the Bills by the Governor

- Governor can give his approval and it becomes Act

- Governor can Reject the Bill any no. of times

- Governor can exercise a pocket veto

- Governor can exercise a Suspensive veto

- Governor can refer the Bill to the President

- Telangana Government approached SC and asked the SC to look into the matter as the governor did not pass the Bills.

- In Punjab, the Governor was not convening a state assembly.

- Solution- Implement the recommendations of the Sarkaria Commission, M M Punchi Commission, etc

- After 2004-

- UPA came to power, and they asked the Governors appointed by the previous governor to resign. Some governors were removed as they enjoy the pleasure of the President.

- They approached the SC and SC gave judgment regarding the appointment of Governors

- SC stated that governors are custodians of the Constitution. Governors are not representatives of any political party.

- SC said that whenever a new government comes to power at the centre, the governors need not resign.

- SC stated that if the government wants to remove the governor then a report can be sent to the President explaining the reasons for the removal. The president must satisfy with the reasons given by the CoM.

- SC stated that this report can remain confidential report.

- Reasons for Politicization of the Governor- No post-retirement benefits, No security.

- SC stated that the Governors should be given post-retirement benefits.

- After 2014-

- BJP came to power and they wanted to remove the Governors appointed by the previous government.

- BJP used the method of Transfer and past corruption cases against the Governor to dismiss the Governor.

ALL INDIA SERVICES

- No Federal country has the provision of All India Services as it goes against the idea of Federalism

- Sarkaria Commission and M M Punchi Commission strongly recommended continuing with the AIS as they have a Macro-nationalistic perspective

- They also recommended more AIS.

RECOMMENDATIONS OF VARIOUS COMMISSIONS

- Regarding discretionary powers of Governors

- These commissions have recommended that Governors must use their discretionary powers to promote and improve better centre-state relations.

- Governors must act as the catalyst in realizing the objectives of cooperative Federalism.

- As a norm, the governor should always give his approval to the Bills passed by the state legislative assemblies. They should not come in the way of the effective functioning of state administration.

- In the case of any conflict, the governor can always inform the state government about his objections so that the state government can take corrective measures.

- As a last resort, the governor can reserve the Bill for Presidential approval as recommended by the M M Punchi commission, the president can give his opinion within a period of two months so that it can lead to better Union-state relations.

- As a rule, the Governor should not interfere in the day-to-day administration of the state government as repeatedly mentioned by SC in various judgments, Governor should refrain from actively participating in state politics. It can lead to the creation of rival power centres at the state level.

- When any political party withdraws support to the Government, Governor should provide sufficient time to the Chief Minister to prove his majority on the floor of the house.

- To promote cooperative federalism, as suggested by the Punchi Commission, the central government should resist the temptation of making legislation for items/ subjects in the state list. On the other hand, wherever it is possible more powers and freedoms should be given to state governments in the true spirit of cooperative Federalism.

- These commissions also have strongly supported a continuation of All India services. They have demanded more All India Services to ensure inclusive and equitable growth.

CENTER-STATE FINANCIAL RELATIONS

- Major issues

- a) Composition of Finance Commission

- b) Terms of reference of the Finance Commission

- c) Vertical and horizontal tax devolution

- d) FRBM

- e) Cess and Surcharge

- f) Centrally Sponsored scheme

- g) Special category status

- h) Disaster relief

- i) Pay Commission

- j) Sharing of revenues

- h) Sale of PSEs.

MAJOR ISSUES IN FINANCIAL RELATIONS

- A. Finance Commission

- It is a constitutional body. It also enjoys complete independence under Article 280 of the Indian constitution.

- Controversies

- a) Members of the Finance Commission are appointed by the Central government without any participation of states. There is the possibility that they will favour the central government in deciding the share of finances.

- Solution- M M Punchi commission said that members of the Finance Commission can be appointed in consultation with the state governments. If this is not possible then in Finance Commission there can be some members appointed by the State government.

- b) Terms of reference-

- The president asks the Finance Commission to decide the Devolution of taxes (Horizontal and Vertical devolution)

- [* Vertical devolution is the devolution of funds between the centre and States/union territories. Horizontal Devolution is the division of funds amongst states.]

- Grants-in-aid to overcome their revenue deficit

- Any other matters referred to Finance Commission by President.

- Recommendations by Punchi Commission- M M Punchi Commission recommended that Terms of reference can only be decided with the consultation of states.

- Vertical Devolution of tax revenues

- Central government performed only 30% of activities without the involvement of states. 70% of the functions are performed by states.

- Earlier 70% of the revenues were given to the center and only 30% of the revenue went to states.

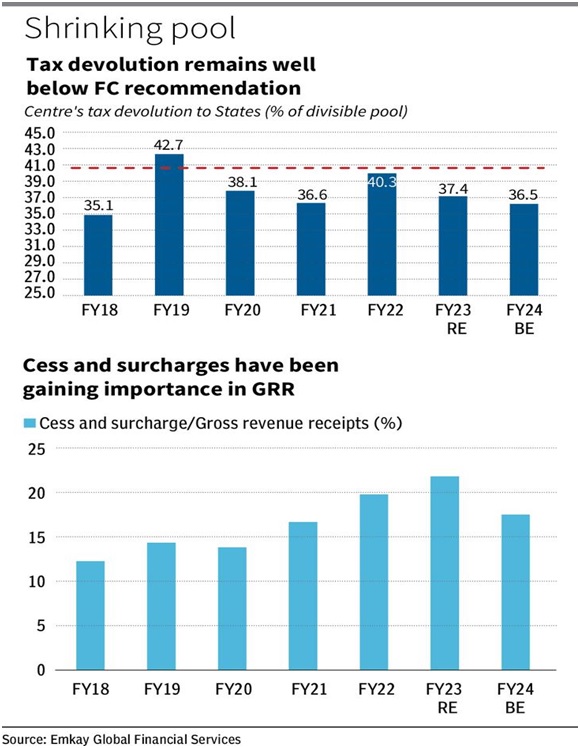

- 14th FC increased revenue sharing from 32% to 42%. [* 15th FC made it 41%. ]

- Solution- M M Punchi commission recommended that the share of the state's share in the revenue should be progressively increased to 50%.

- Central government increased the cess and surcharge which was not to be shared with states.

- Solution- M M Punchi commission recommended that these Cess and Surcharges should be discontinued. An increase in cess and surcharge goes against the spirit of Federalism.

- Horizontal devolution of the tax revenues

- India has Asymmetrical federalism so a formula was devised to share the revenue among states.

- First FC came out with a formula based on EQUITY and EFFICIENCY to decide the revenue.

- Equity- biased in favour of the disadvantaged. It includes Population, Size of state, Poverty/ Income distance, Unemployment, etc

- Efficiency- Ability of the state to perform well.

- Issues- Those states which are performing well had complained that they are penalized as FC is giving priority to Equity.

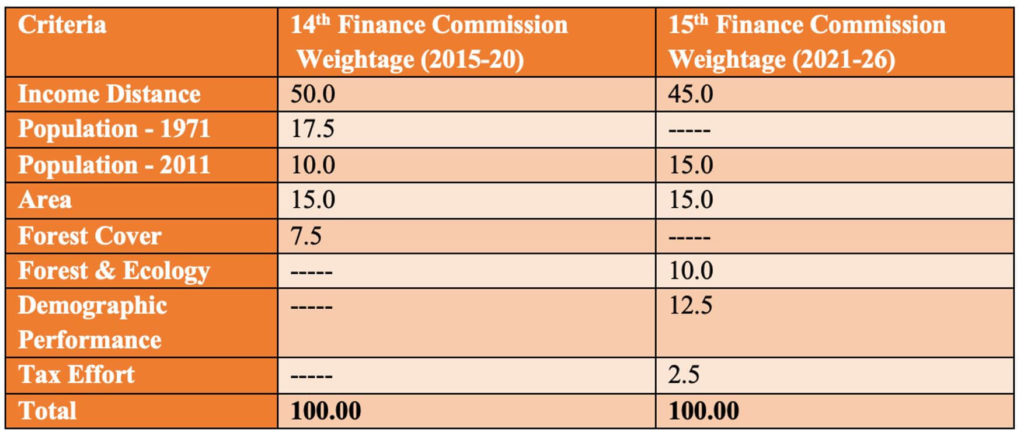

- In terms of reference to the 15th FC, the Central government asked the FC to use 2011 census data instead of 1971 census data. It penalized the states which controlled the population.

- Income distance is calculated as the difference between the per capita gross state domestic product (GSDP) of the state from that of the state with the highest per capita GSDP.

- The performing states are arguing that when they are increasing their Per capita Income, then they are getting less share as they will come closer as per the income distance formula.

COMPARISON OF 14TH & 15TH FINANCE COMMISSION

- How the concerns of the South Indian states were covered in the 15th FC?

- 15th FC gave only 15% weightage to the 2011 census and they included Demographic performance and they gave 12.5% weightage.

- Those states who performed well in containing the population were also incentivized.

- In 15th FC, a new parameter was introduced i.e. ecology and forest i.e. who are working towards sustainable development will be given benefit.

- Those states who are increasing their tax revenues will be given benefits.

The topic for the next class:- Other Financial relations between center and state, Inter-state water disputes.

0 Comments