Economics_RS Class 04

Economics_RS Class 04 (05:02 PM)

A brief overview of the previous class (05:02 PM)

ECONOMIC HISTORY POST-1990s (05:04 PM)

- The situation since the 1990s

- PSUs were not performing well, not profitable. Revenues for the government were less.

- Inflation was high because of the problem of the Oil crisis since the 1970s as OPEC countries were not supplying oil.

- After the Nationalisation of banks in 1969 (14 banks) and 1980 (6 banks), the Public sector banks were not doing well.

- The situation of trade deficit- It was high (Import of food, fuel, and fertilizer).

- Government Budget- The government was spending more than its earning. Government has to borrow more for more spending. This increased the government borrowing and it led to a high deficit.

- Fiscal deficit= Borrowing= The borrowing done by the government in order to spend more.

- [* During COVID, the government needs to spend more and its deficit will increase. During the crisis, pandemic, and during Fiscal stimulus, government borrowing increases.]

- RBI which is the custodian of the FOREX reserve was not able to maintain a sufficient reserve of FOREX. India lacked the import cover for 15 days.

- Since the 1970's India's macroeconomic indicators were declining, India wanted to bring structural reforms but India failed. Reasons were

- 1) Politicisation of the planning process

- 2) Emergency

- 3) War- 1962, 1971

- 4) Oil crisis

- 5) Disintegration of USSR

- 6) FOREX reserve was not sufficient.

- The Financial crisis, IMF (International monetary fund) help all its member countries during the financial crisis. IMF gives conditional loans. It asked India to open its economy.

- IMF prescribes certain conditions when they BAIL OUT a country during a crisis.

- [* Now, BRICS banks came up with a Contingent reserve arrangement to help a country during the crisis. This was a reaction against IMF conditional loans]

- IMF asked to take some structural reforms. India slowly moved toward an open economy/ market economy.

- Loan v/s Grant

- Zero interest loan, Interest loan - Paying back the principal amount.

- Grant- It is a kind of donation or gift. It is one side transfer.

- New economic reforms/ LPG reforms (05:29 PM)

- India was obligated to bring structural reforms. India lacked the required systems/infrastructure to implement those reforms.

- Also, the world was moving towards a Unilateral world order led by the USA and capitalist countries.

- So India also followed the market-led development.

- Decrease the regulation by the government, and decrease license culture.

- Prices of goods and quantity of goods were to be decided by the Market mechanism.

- Allow the easy flow of investment.

- Liberalisation- Liberalising government control, removing restrictions, decreasing license raj.

- What becomes more important in a such globalized market?

- Efficiency- with respect to labour, manufacturing, productivity, after-sale, and delivery of services.

KEYWORDS RELATED TO FOREX (05:46 PM)

- Fiscal deficit- it is borrowings of the government

- FOREX reserve- In India, RBI is the custodian of the FOREX reserve

- There are 4 main components of the FOREX reserve

- 1) Foreign currency assets

- 2) Gold (hard currency)

- 3) SDRs- Special drawing rights

- 4) Reserve Tranche position

- Why so much demand for gold in India?

- 1) Tradition

- 2) Black money

- 3) Banking penetration, Less Financial inclusion

- 4) Gold is used as a Hedging instrument

- [* Hedging means avoiding risk. It is used in the case of inflation. During inflation, one can not hold the cash, or putting the money in the bank is also not a good option so the only option is to buy gold]

- Hedging- It means avoidance of risk

- Conditional loans- These are loans given by International banks like IMF and World bank. India was dependent on IMF, especially after the economic crisis of 1991

- Grants- Grants are unilateral transfers that need not be paid back.

- Supply chain management- It covers all the aspects from the production of the product to the final delivery. It includes logistics, packaging, transportation etc. The supply chain deals with both backward and forward integration.

- [* For FCI, Backward integration is Farmers who provide rice, and wheat.

- Backward integration change with respect to the reference, for a farmer, backward integration can be seed, and forward integration can be FCI.

- AMUL- can get milk from cooperatives which are backward integration, and it also has Small icecream manufacturers from where the consumers are buying products ]

- Backward integration- is nothing but moving toward the supplier

- Forward integration- moving towards the final consumer.

LPG ERA (06:03 PM)

- Liberalization, Privatization, and Globalization.

- Liberalization- reducing government restriction, ending the license raj era.

- Privatization- Allowing more private players into business.

- Globalization- the whole globe is a single market for doing business. Globalization involves the free movement of goods and services, investments, and labour.

- After LPG reforms, India had to move from Import substitution to Interdependence.

POST LPG ERA [ 1991-2004 ] (06:11 PM)

- Pre-1991, Agriculture had the largest contribution to GDP, whereas, in post-1991, the Tertiary sector contributes more to the GDP. This is also called Over-Tertiarization. [India jumped to the service sector from the agricultural sector bypassing the manufacturing sector]

- [* Jobless growth- the maximum chunk of the population is engaged in Agriculture and it is contributing only 17-18% to GDP. It means the workers engaged in this have less income. Indians were called Software coolies in developed countries. ]

- Pre-1991, The public sector was creating jobs, whereas in, post-1991, the private sector was creating jobs.

- Pre-1991, India was a closed economy, whereas, post-1991, India became an open economy.

- Pre-1991, India's policy was import substitution industrialization, whereas, post-1991, India's approach was interdependence.

- Pre-1991, India adopted socialism & Mixed economy, whereas, post-1991, India adopted market led economy (Demand and supply)

- Pre-1991, India's growth rate was less (less than 3.5%), which was also called as HINDU RATE OF GROWTH, Whereas post-1991, India crossed the Hindu rate of growth and now India is growing at 7-8%.

- Pre-1991, challenges of Unemployment were higher and the situation is the same in the post-1991 scenario.

- Pre-1991, the challenges were related to Growth i.e. economic growth, whereas, in post-1991, the challenge is more related to inclusive growth as inequalities are increasing.

- [* Do you think market economies can become inclusive? Or, Why the need arises for inclusive growth?- Due to LPG reforms and the rise in inequality. If inclusive growth is a wider circle then one also requires financial inclusion. Financial inclusion will reduce leakages, and it will enhance government policies, Role of moneylenders will reduce. ]

- Financial inclusion is important for economic growth as well as inclusive growth.

- Question- Over- Tertiarization of the Indian economy has led to jobless growth- Too much of the service sector boosted the economy but it did not create many jobs. Foreign investors and private investors decided to invest money in the service sector and not in the manufacturing sector because the manufacturing sector lacked sufficient infrastructure.

- Pre-1991, Poverty was on the higher side, Post-1991, we reduced the incidence of poverty but it was not satisfactory as china reduced more.

- Pre-1991, a Major chunk of the population was dependent on the agriculture sector. Post 1991, also the major chunk of the population is engaged in agriculture (42.4%). This is a problem for the Indian economy.

- Pre-1991, foreign investment was less, whereas, post-1991, foreign investment exponentially increased.

- Pre-1991, Foreign investments were regulated through an Act FERA, any foreign investment-related crime was seen as a criminal offence. It means more stringent regulation, whereas, post-1991, foreign investment is regulated by FEMA. FEMA is the more liberal arrangement.

- Pre-1991, Handling black money was easy for the authorities, Whereas, post-991, handling black money is difficult for the authorities. [* Companies can use tax evasion, the Hawala route, tax havens, money laundering etc]

- How can government shift the labour from agriculture to the manufacturing sector?

- Developing more allied sectors such as Fisheries, animal husbandry

- The food processing sector is an intermediate sector between the agriculture and the manufacturing sector. It creates additional jobs. Agricultural wastage can be reduced.

- Create more labour-intensive sectors such as the textile sector, apparel sector, leather, etc

OVER-TERTIARIZATION OF THE INDIAN ECONOMY (06:44 PM)

- It is nothing but the services sector dominating the economy. In a regular economic transition, a country moves from the primary sector to the secondary and then subsequently to the tertiary sector unlike India, where there was an abrupt shift from primary to tertiary neglecting the secondary sector and leading to Over tertiarization of the Indian economy.

- Over-tertiarization has led to jobless growth [* Jobless growth- economic growth without adequate job creation]

- Over-tertiarization also increased pressure on land i.e. pressure on agriculture leading to the problem of DISGUISED UNEMPLOYMENT

- Disguised unemployment- is mainly related to agriculture. There are more people than required who are working on the farm. The marginal productivity of additional labour is almost zero.

- Hindu rate of growth- Low levels of economic growth, less than 3.5%.

- Due to LPG reforms, India was able to cross the Hindu rate of growth.

- Foreign Exchange Regulation Act (FERA)- FERA was a stringent Act regulating foreign exchange and any foreign exchange-related crime under FERA was seen as a criminal offence.

- FEMA 2000- FERA was replaced by a liberal Act, FEMA (Foreign Exchange Management Act). Currently, FEMA regulates aspects related to Foreign exchange and black money. Any foreign exchange-related crime under FEMA was seen as a civil offence.

BLACK MONEY (07:11 PM)

- Tax havens- These are the countries where the tax rules are very liberal and the government does not ask about the source of the money. Example- Cayman Islands, Cyprus, Mauritius

- Routing the Black money to these tax havens countries became easier. So handling the black money became difficult for the authority after 1991.

- FERA was very strict, so handling black money was easier for authorities, pre-1991, whereas FEMA was liberal hence, handling the black money was difficult for the authorities post-1991.

MARKET MECHANISMS (07:16 PM)

- It means forces of demand and supply.

- Demand= willingness to buy+ and ability to pay.

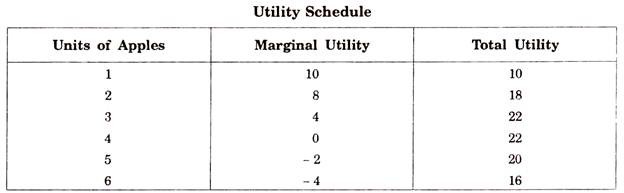

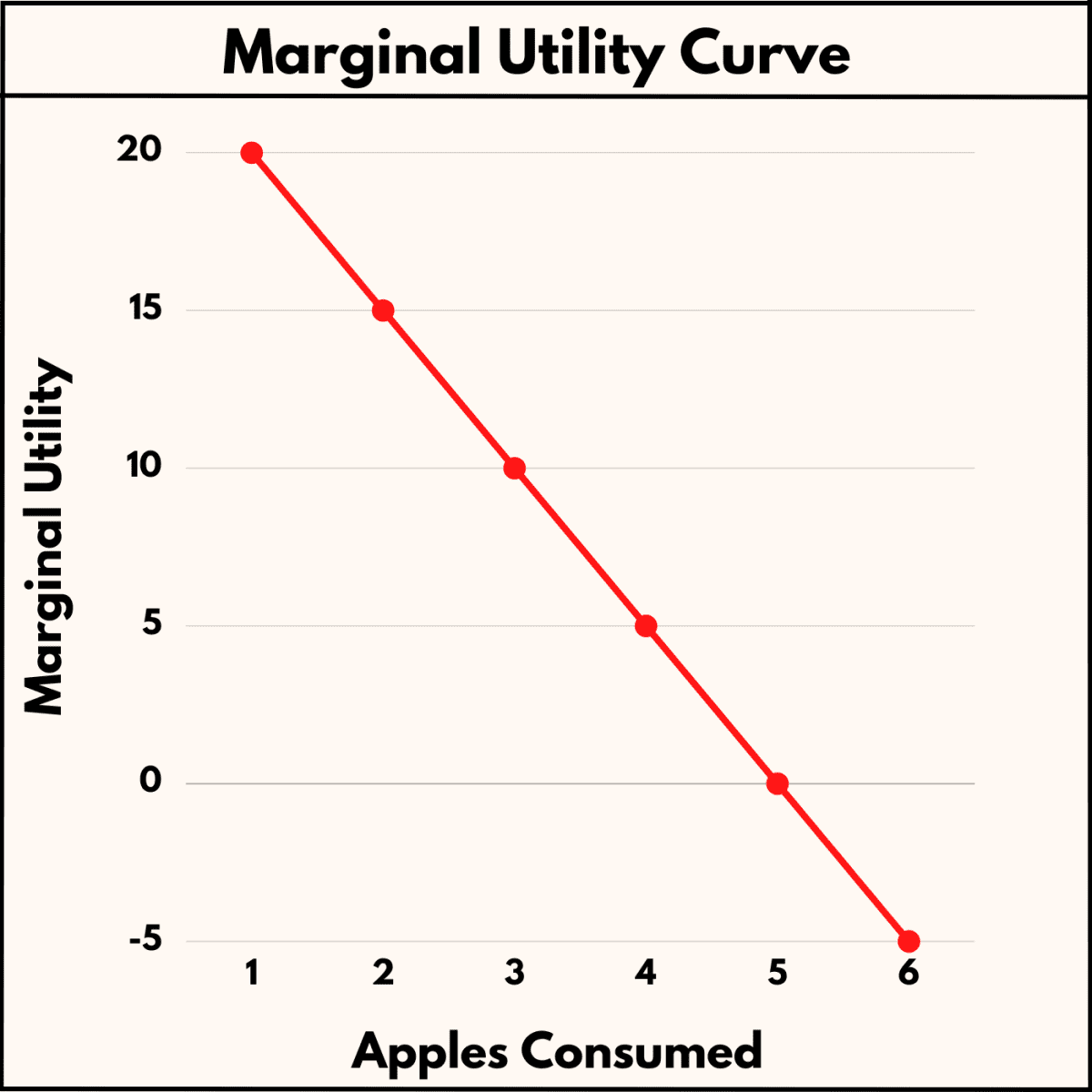

- Law of diminishing marginal utility

- For every additional commodity we consume the marginal utility is going to decrease.

- For each additional commodity, marginal utility is decreasing, so one will pay a lesser amount.

- Demand graph will be RIGHTWARD Sloping.

- Price has an inverse relationship with demand.

- When incomes are increasing, then at the same price, one will be interested in buying more products.

- The demand graph will shift Rightwards. When it shifts rightwards, it indicates favourable demand.

- Income-demand graph

Exceptions to the regular law of demand (07:35 PM)

- Inferior goods- For example- Rice and millet. These are an exception to the regular law of demand. As the income is increasing the quantity demanded of the inferior good is decreasing due to available substitutes etc

- Veblen Goods- These are also an exception to the regular law of demand. These are precious and status-oriented goods. Example- Rolls Royce.

- Note:- Rightward shift with respect to the demand graph will indicate favourable demand

BALANCE OF PAYMENT CRISIS (07:47 PM)

Balance of Payment Current account

- Settled simultaneously.

Trade account

- Goods / Merchandise trade

- It is visible

Imports Exports Services account Capital Account - India has a huge trade deficit during the 1990s. Oil became costlier because of the Gulf war. Import bill increased. It means more dollars are flowing out of the account. The deficit will increase.

- During the 1990s Oil became costly. The dollar supply in India decreased. In the FOREX market, a country requires more rupees to buy dollars. The rupee value will depreciate. The currency value will decrease.

- Balance of payment

- It is an accounting statement that records the economic transactions of the residents of the country with the rest of the world in one financial year.

- BoP has two sub-accounts i.e. current account and a capital account.

- Balance of Trade

- Balance of Trade is a sub-component under the current account which measures the export and import of merchandise goods or goods only.

- BoT surplus means exports are greater than Imports.

- Balanced trade means exports are equal to Imports.

- BoT deficit means imports more than exports.

- Note:- Increase in BoT deficit will lead to depreciation of currency (Rupee)

The topic for the next class: Other components of the Balance of payment.

Questions for practice

1)

Disguised unemployment generally means

(a)A large number of people remain unemployed

(b)Alternative employment is not available

(c)The marginal productivity of labor is zero

(d)Productivity of workers is low

2)

According to the law of diminishing marginal utility:

(a)Utility is at a maximum with the first unit

(b)Increasing units of consumption increase the marginal utility

(c)Decline in the marginal utility that person derives from consuming each additional unit of that product

(d)Total utility will increase at a declining rate as fewer units are consumed

3)

Consider the following about Inferior goods:

An inferior good is a type of good whose demand increases when income rises.

The demand for inferior goods is inversely related to the income of the consumer.

Which of the statements given above is/are correct?

(a)1 only

(b)2 only

(c)Both 1 and 2

(d)Neither 1 and 2

4)

The Gross fiscal deficit includes:

(a)Net borrowing at home

(b)Borrowing from RBI

(c)Borrowing from abroad

(d)All the above.

5)

What were the reasons for introducing the economic reforms in 1991?

The Gulf war

Balance of payments Crisis.

Increase in fiscal deficit

Choose the correct answer from the codes given:

(a)1 and 2 only

(b)2 and 3 only

(c)1 and 3 only

(d)1,2 and 3

6)

Post 1970s India tried to bring structural reforms but failed, What can be stated as reasons for such failure?

The politicisation of the planning process

Emergency

Oil crisis

Disintegration of USSR

FOREX reserve was not sufficient.

Select the correct code from the options

(a)1, 2,3& 5 only

(b)2& 4 only

(c)3& 5 only

(d)1,2,3,4 & 5

7)

What is/are the component(s) of Forex reserve?

Foreign currency assets

Gold

SDRs- Special Drawing Rights

Reserve Tranche position

Select the correct code from the options

(a)1 only

(b)3 and 4 only

(c)1,2, and 3 only

(d)1,2, 3 and 4

8)

In the context of the Economic history of India the term "Hindu rate of growth" signifies-

(a)It means growth of all Hindi speaking countries.

(b)It means a low level of economic growth.

(c)It means the population growth of the Hindu community in comparison to other community.

(d)It means the level of literacy among the Hindu community.

9)

In the context of Black money consider these statements

FERA and FEMA are legislations to curb the Black money.

FERA is a liberal Act and handling the black money by the authorities is easier whereas FEMA is a stringent Act and handling the black money by authorities is very difficult.

Which of the above statement(s) is/are correct?

(a)1 only

(b)2 only

(c)Both 1& 2

(d)None of the above

10)

How can government shift the labor from agriculture to the manufacturing sector or services sector? (150 words/ 10 marks)

11)

Explain the law of demand and supply. Also, mention the exceptions to this regular law of demand and supply. (10 marks/ 150 words)

12)

What do you understand by Over-tertiarization? Discuss the impact of Over-tertiarization on the Indian economy. (10 marks/ 150 words)

Answers

1) c

2) c

3) b

4) d

5) d

6) d

7) d

8) b

9) a

Q1.

The year 1991 is considered a Watershed moment in the Economic history of India. Comment. (10 marks/ 150 words)

(10 marks)

0 Comments